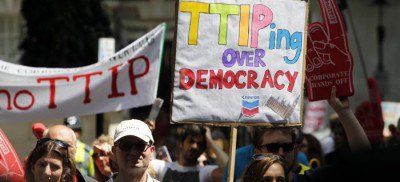

On November 14th, German Economic News (which this writer has found to be the world’s most honest, non-propagandistic, newspaper) published two articles about, and they also posted to the Internet, the first independent study of the likely impacts of the Obama-proposed Transatlantic Trade and Investment Partnership (TTIP). This study, by an American economist, concludes:

On November 14th, German Economic News (which this writer has found to be the world’s most honest, non-propagandistic, newspaper) published two articles about, and they also posted to the Internet, the first independent study of the likely impacts of the Obama-proposed Transatlantic Trade and Investment Partnership (TTIP). This study, by an American economist, concludes:

We offer an assessment of TTIP based on a different model and more plausible

assumptions on economic adjustment and policy trends. Using the United Nations Global

Policy Model we simulate the impact of TTIP on the global economy in a context of

protracted austerity and low growth especially in the EU and US.

Our results differ dramatically from existing assessments. For Europe we find that:

* TTIP would lead to losses in terms of net exports after a decade, compared to the

baseline “no-TTIP” scenario. Northern European Economies would suffer the largest

losses (2.07% of GDP) followed by France (1.9%), Germany (1.14%) and United

Kingdom (0.95%).

* TTIP would lead to net losses in terms of GDP. Consistent with figures for net

exports, Northern European Economies would suffer the largest GDP reduction (-

0.50%) followed by France (-0.48%) and Germany (-0.29%).

* TTIP would lead to a loss of labor income. France would be the worst hit with a loss

of 5,500 Euros per worker, followed by Northern European Countries (-4,800 Euros

per worker), United Kingdom (-4,200 Euros per worker) and Germany (-3,400 Euros

per worker).

* TTIP would lead to job losses. We calculate that approximately 600,000 jobs would

be lost in the EU. Northern European countries would be the most affected (-223,000

jobs), followed by Germany (-134,000 jobs), France (- 130,000 jobs) and Southern

European countries (-90,000).

* TTIP would lead to a reduction of the labor share (the share of total income accruing

to workers), reinforcing a trend that has contributed to the current stagnation. The

flipside of its projected decrease is an increase in the share of profits and rents,

indicating that proportionally there would be a transfer of income from labor to

capital. The largest transfers will take place in UK (7% of GDP transferred from labor

to profit income), France (8%), Germany and Northern Europe (4%).

* TTIP would lead to a loss of government revenue. The surplus of indirect taxes (such

as sales taxes or value-added taxes) over subsidies will decrease in all EU countries,

with France suffering the largest loss (0.64% of GDP). Government deficits would GDAE Working Paper No. 14-03: TTIP: European Disintegration, Unemployment and Instability and

also increase as a percentage of GDP in every EU country, pushing public finances

closer or beyond the Maastricht limits.

* TTIP would lead to higher financial instability and accumulation of imbalances. With

export revenues, wage shares and government revenues decreasing, demand would

have to be sustained by profits and investment. But with flagging consumption

growth, profits cannot be expected to come from growing sales. A more realistic

assumption is that profits and investment (mostly in financial assets) will be sustained

by growing asset prices. The potential for macroeconomic instability of this growth

strategy is well known after the recent financial crisis.

The report starts by pointing out that the official analyses are based upon the same macroeconomic assumptions that had produced the 2008 economic crash and the subsequent increased concentration of wealth among the super-rich and stagnation for everyone else. This report, by contrast, applies a set of assumptions that, if they had been applied prior to the crash, would have averted the crash; and, moreover, that are in accord with the large and mounting body of empirical research findings in economics, which show that the prior assumptions are simply, and rather consistently, false.

The study notes that, consistent with the now existing massive body of empirical findings in economics, “any viable strategy to rekindle economic growth in Europe would have to build on a strong policy effort in support of labor incomes.” By contrast, the Obama plan (TTIP) would focus instead upon increasing benefits to stockholders at the expense of workers and of everyone else. The reason for the “higher financial instability” is that by lowering consumers’ incomes, corporate sales ultimately must go down. The super-rich do not spend enough on their yachts and mansions for the economy to be able to keep on rising. Ultimately, the increased take by the super-rich ends up harming even themselves (though only after they’ve already taken their enormous cuts and socked those away in offshore accounts, etc.). The old economics ultimately fails for even the super-rich, except that they get bailed out by everybody else once the old Ponzi-economy has crashed and the “Too Big To Fail” institutions get restored to economic health. (This is why income and wealth are becoming increasingly concentrated: the super-rich get bailed out when the economy crashes; workers and consumers do not.)

Basically, the Obama plan, which, in the United States, is supported by Republicans in Congress, and also by conservative Democrats such as President Obama, Hillary Clinton, and Joe Biden, would further sink Europe.

The study focused only upon Europe, because this deal is being proposed to Europe.

The study was performed by Jeronim Capaldo at Tufts University, and is titled: “The Trans-Atlantic Trade and Investment Partnership: European Disintegration, Unemployment and Instability.”

I spoke with Dr. Capaldo by phone, on November 16th, about what he expects the effects would likely be on Americans; and he said that while he cannot comment in detail upon that (because he hasn’t performed all of the necessary calculations), the deal is even more favorable to U.S.-based international corporations than to EU-based ones, and so it would probably boost profits for U.S.-based firms. However, since the deal is heavily slanted against workers everywhere, in favor of investors, U.S. workers would likely experience further wage-cuts, and an even larger share of income would go to stockholders, if this deal were to be accepted by the EU and passed in Congress. (The chances of its being actually passed in Congress soared when Republicans were elected this month into control of the U.S. Senate, because opposition by Senate Democrats is what had previously blocked its chances. The only thing that could block its chances now is rejection by the European Union.)

In short, then: the Obama plan is designed by and for the billionaires who control large international corporations (especially U.S.-based ones); it’s more of the same economics that had produced the 2008 crash, only now imposed internationally. Official Europe (representing Europe’s oligarchs) is supporting it, but the economic data indicate that European economies would actually be greatly weakened by it. The question for Europe is whether they’ll continue being controlled by their oligarchs. And that’s the same question in America (where it seems to have been answered in the affirmative on November 4th).

Recent Comments

NRP in: Spotkanie "normandzkiej czwórki"odwołane

Czy wiadomo dlaczego spotkanie nie dojdzie so skutku? ...

NRP in: Ukraińcy w Polsce

Straszna tragedia dla narodu Ukrainy. Dobrze, że młodzi ludzie nie chc ...

NRP in: Polacy w Donbasie: Aleksandrówka

Często tu zaglądam i nie mogę się nadziwić, że nawet pod tekstami doty ...

Zabo in: Russia fails in bid to stop U.N. staff benefits for all gay couples

L'Occident pourri jusqu'à la moelle a perdu son âme ! Le seul défenseu ...

Zabo in: Kiev's poison pill for Minsk 2.0

Dieu qu'ils sont laids !!! ...