The restructuring deal that Ukraine has agreed with its main creditors isn’t over the finishing line yet.

A group of bondholders owning the nation’s shortest-dated international debt said on Tuesday that the agreement is biased against them because their payments are delayed for more years than everyone else. While they may not yet have enough support to block a deal, a letter issued by their solicitors asked for other owners of the securities to join them.

The emergence of the possible holdouts is the first threat to a deal announced on Aug. 27 by Ukraine and a Franklin Templeton-led creditor committee that owns about half of the nation’s outstanding Eurobonds following five months of negotiations. WhileRussia has said it won’t take part in the restructuring, its objections aren’t expected to derail the whole agreement because it’s the sole owner of a $3 billion note.

Ukrainian bonds, including those maturing this month and next, surged when the terms of the restructuring deal were revealed to be better than many investors were expecting. As well as extending the maturity on about $18 billion of debt, it also includes a 20 percent reduction to face value, higher average interest payments and warrants that would pay holders if the nation’s economy regains traction.

Allocation Request

While the current deal gives holders a share in nine notes maturing from 2019 to 2027, the group, represented by law firm Shearman & Sterling LLP, is seeking to change the allocation of the new securities so that its payments are delayed for approximately four years, according to a letter to bondholders sent by e-mail. Shearman & Sterling didn’t name any members of the group or say how many bonds its members own.

The heads of terms agreement for the restructuring doesn’t specify how the bonds should be distributed but says Ukraine and the creditor group may agree to adjust the allocation to shorter-dated notes in order to push through a deal. This means that a “uniform extension of maturities” can be easily accomplished, the law firm said in the letter.

A spokesman for the Franklin Templeton-led creditor committee said he wasn’t able to comment when contacted by e-mail on Wednesday.

2015 Premium

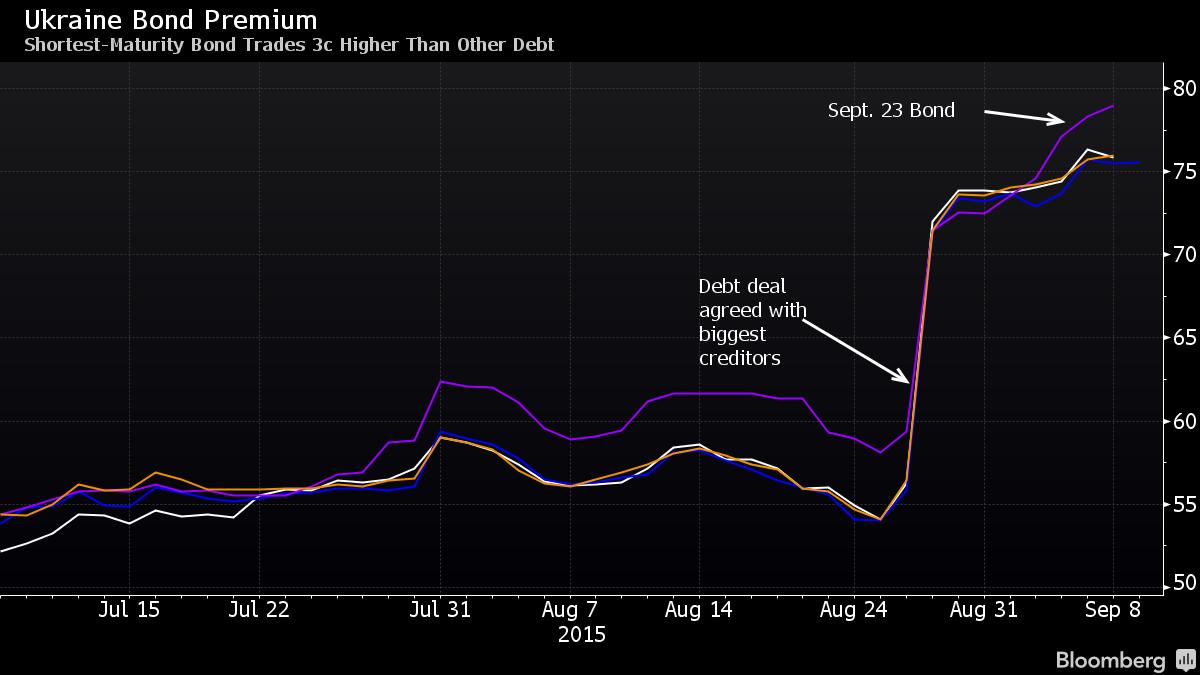

Ukraine has $500 million in dollar-denominated bonds maturing Sept. 23 and a 600 million-euro ($671 million) note due Oct. 13. In the months running up to the deal, those bonds traded at a premium to the nation’s longer-dated securities. After getting wiped out following the announcement, the gap has widened again with the Sept. 23 note trading 3.05 cents higher than the country’s July 2017 bonds by the close in Kiev on Tuesday.

“The vast majority of bond restructurings are done by giving bondholders the same exit terms,” Anna Gelpern, a Georgetown University law professor and fellow at the Peterson Institute for International Economics, said by phone on Tuesday. “The assumption is that the closer you get to restructuring or default, everyone’s claim collapses into par and then you’re just exchanging par for par. That doesn’t mean that the short end doesn’t constantly try to make a case for preferential treatment.”

The Franklin Templeton-led creditor committee owns a blocking stake in the Sept. 23 bond, which means at least 25 percent, a person familiar with the group’s holdings who declined to be identified said in July. TCW Investment Management Co., one of four members of the creditor group, owns the bulk of that share, with about 21 percent, according to data compiled by Bloomberg.

Publicly available data don’t give a complete picture of the creditor group’s ownership because some funds aren’t disclosed and the information is published with a lag.

Parliamentary Approval

Finance Minister Natalie Jaresko is awaiting parliamentary sign-off on the agreement. It will then be sent to other bondholders for approval.

To get the restructuring deal passed, 75 percent of bondholders need to vote in favor at a meeting in which two thirds of creditors are represented. Ukraine’s bonds don’t contain so-called aggregation clauses, which allow a deal to be pushed through on all securities if holders of 75 percent of the total debt are on board.

The group asking for the deal to be changed “can complicate the situation, but only if the holders involved in this motion have enough shares to be able to block the majority,” said Lubomir Mitov, the chief economist for eastern Europe at UniCredit SpA. “I can understand the desire of these holders, because they are the ones who are about to get their money but face a multi-year delay.”

Source

Recent Comments

Drago in: Les intercepteurs allemands jouent à la psychanalyse

La seule chose sur laquelle je m'interroge c'est... en combien de fo ...

Марина in: Телефоны «горячей линии» Центрального Республиканского банка ДНР

Здравствуйте с какого банка в Москве можно сделать перевод в Горловку ...

Ten_drugi_Adam in: Czesi przeciwko UE

Brawa dla braci Czechów! ...

Ten_drugi_Adam in: Biathlon czołgowy (foto)

Tank biatlon, super sprawa;) Lubię oglądać na yt szkoda tylko że Polac ...

keg in: L'exode des peuples, ce facteur de trop qui fera sauter l'UE

Et si les migrants venaient ua secours des Peuples opprimés européens, ...