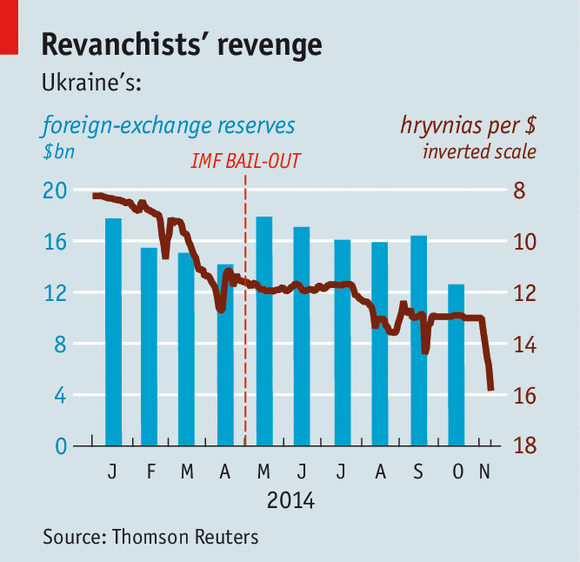

Things could get a lot worse quite fast. Timothy Ash, head of emerging-market research at Standard Bank, suggests that the hrvynia could fall from its current level of around 15 to the dollar, which itself is a 50% fall over 2014, to as much as 25 (see third chart). Earlier this year, it was trading at 8 to the dollar.

Things could get a lot worse quite fast. Timothy Ash, head of emerging-market research at Standard Bank, suggests that the hrvynia could fall from its current level of around 15 to the dollar, which itself is a 50% fall over 2014, to as much as 25 (see third chart). Earlier this year, it was trading at 8 to the dollar.

In response to further currency declines, the central bank may push interest rates even higher (the discount rate currently sits at 14%). That will wreak further havoc with Ukrainian banks, where non-performing loans make up about one-third of their assets (though some say it is much higher than this). It will also crimp business by raising their financing costs: even agriculture, which many people saw as a bright spot, is struggling.

A weaker hrvynia will add to inflation, currently at nearly 20%, which will further erode the purchasing power of the population. (Ukraine’s central bank is not exactly helping matters: on its website, mistakenly, it suggests that the inflation rate is above 100%). Currency depreciation also makes it more difficult to repay foreign debt. From now until the end of 2016 Ukraine has about $14 billion-worth of external debt repayments. As Mr Ash reports:

Several bankers observed that there are simply no dollars available, and companies are struggling to pay

As a result, Ukraine’s external debt will become a central-bank problem. Mr Ash continues:

the demand for FX seems insatiable at present, and non-payments issues are developing.

Mr Ash agrees with our diagnosis: the West underestimates how serious the situation is. So far the IMF has given Ukraine about one-third of what it promised in April. Our analysis suggests that there is probably a funding gap of about $20 billion. But the IMF is still waiting on the outcome of coalition negotiations in Kiev, which are dragging on, before doling out more dosh. More aid will not be forthcoming at least until 2015: that may not be soon enough.

Of course, this slow car-crash could get much faster in March, when official debt-to-GDP figures may be released. Perceptive readers will remember that in a bond, granted by Russia to Ukraine in December 2013, contained a bizarre clause such that Russia could call in payment on the bond if Ukraine’s debt-to-GDP ratio exceeded 60%. That could trigger a default on all Ukraine’s other international bonds (which are worth about $16 billion up to 2023).

Recent Comments

Natali Sapphir in: Canada to send 200 military trainers to Ukraine, says risk low

So pleasent that people understand thins. Thnak's for your support! ...

Michael Mears in: Canada to send 200 military trainers to Ukraine, says risk low

As a Canadian I am distressed that the Harper government has chosen to ...

Mike Masr in: Right Sector beats up a public activist in Kherson for showing disrespect to Bandera

I am an American of Kuban Cossack ancestry and a Russian Orthodox Chri ...

Natali Sapphir in: В Киеве переименовывают все, что связано с Москвой

Новые названия-это и есть "Жити по-новому", экономические и политическ ...

Natali Sapphir in: The meeting of the heads of the FAM of countries of Norman Four has not been planned

You are right! Nothing. ...